I thought the pivotal moment that would make me feel “old” was when my back started hurting doing normal everyday things like moving houses and carrying boxes.

I realise now that I was wrong.

There’s this rite of passage called “buying a house” which currently feels like the defining moment of adulthood. There are many possible moments in adulthood akin to crossing a “finish line”, only to be another beginning in another race. But in our moment, in this moment, Dylan and I are trying to buy a house together. In this moment our rite of passage involves applying for a home loan, participating in auctions, making offers and negotiating — all for the sweet, sweet feeling of security and stability of having our own home. If renting as a citizen feels bad with the rising rents and low housing supply and increasing rates, renting as a foreigner with no local family ties feels worse.

We’ve been waiting until our Permanent Residency was granted (which we got mid-May) and we wasted no time in finding a broker to kick things off. Despite that, it still felt like a little too late (winter where supply is low, inflation where rates are high). But as immigrants we’re running a race different from everyone else. We couldn’t buy earlier even though we had a sizeable deposit at that time because we can’t get a loan; we couldn’t buy when rates were low; we couldn’t buy when supply was high; we can’t have our parents as guarantors. Everywhere I read said the best time to buy a house is when you can afford it, and if we had to wait this long to get our Permanent Residency then it is what it is. Now that we’ve got our PR, we knew exactly what we needed to do next: having our own home is one of the most important things we need to “settle down.”

Kicking it off is easy; we have good friends who passed on excellent recommendations like a checklist: broker, solicitor. The money side of things isn’t as easy but it’s equally straightforward: how much cash do we have (hard), how much can we borrow (easy), how much do we actually want to spend (tricky)?

Navigating through this house buying process made me miss home for the first time. I missed having “older” adults around to ask for advice. I missed having family who we can run to if we had any unexpected financial roadblocks. In a different country with no family — suddenly I felt more isolated. In this next big step of our life, it’s just me and Dylan. There’s no mama and papa to help with our deposit. There’s no auntie or uncle to give advice on what to look for in a house.

But the rainbow always comes after the rain. It didn’t take too long to feel grateful for what we lucked out on: friends who are willing to teach us how to figure out the suburbs we want to live in, friends who ask us important considerations for a first home, friends who show us what to look out for when inspecting houses (especially old ones), friends who explain concepts on loans and paying off a house, friends who help us get corelogic information because they have access through work, friends who helped us negotiate offers, and friends who always checked in to see how we are in our house-hunting process just to see if we need help with anything.

Advice that helped us find areas/houses we liked:

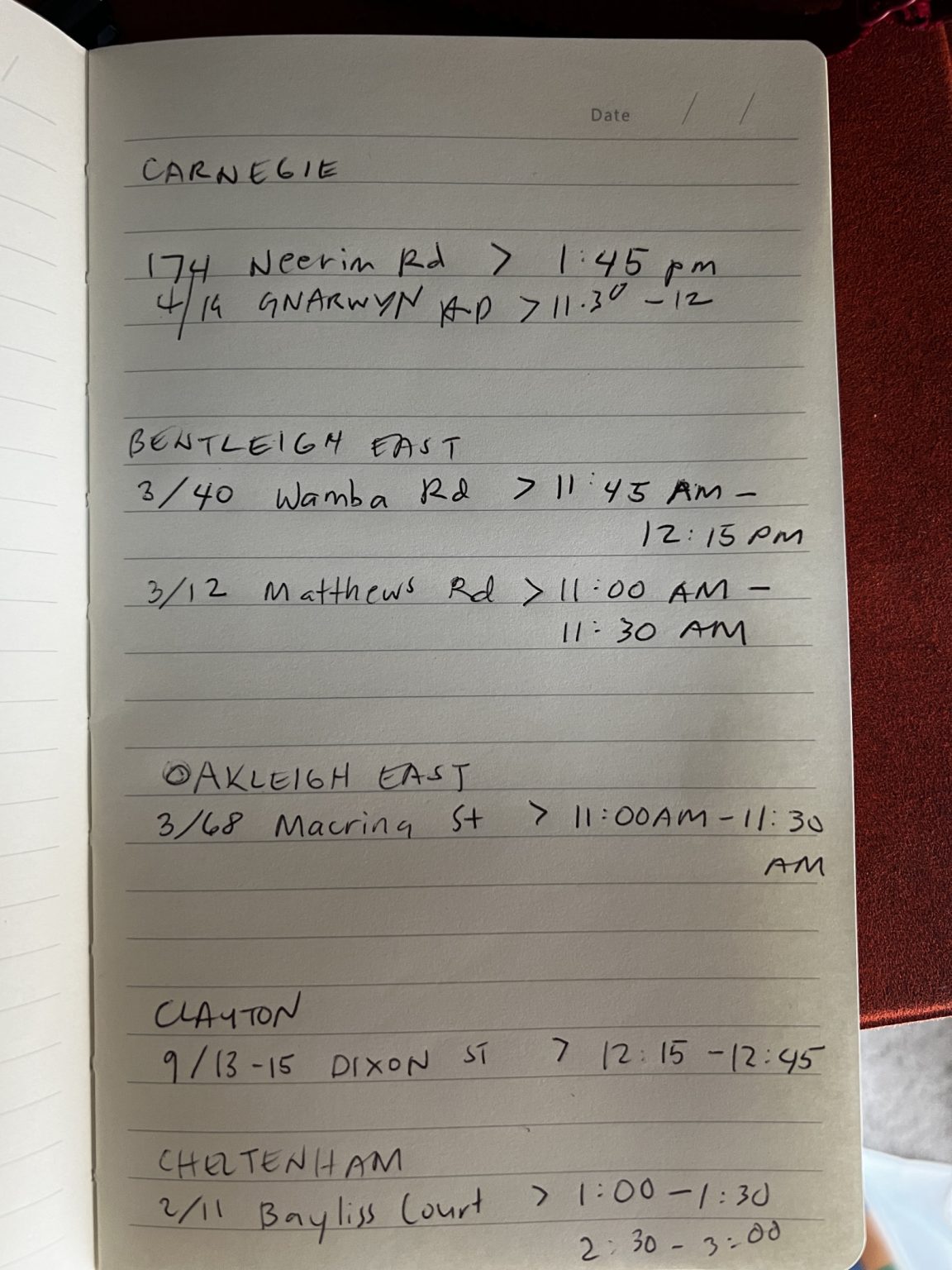

- Drive through different suburbs to figure out where you want to buy. We looked at some houses on Domain/REA with listing prices within our budget and went through those suburbs and easily took off the list the areas with vibes we didn’t like. Some suburbs we thought were okay, but after driving through them we realised it’s not what we were looking for. Some suburbs were in our budget but were dodgy AF. It helped narrow down all the possible suburbs were want to buy in.

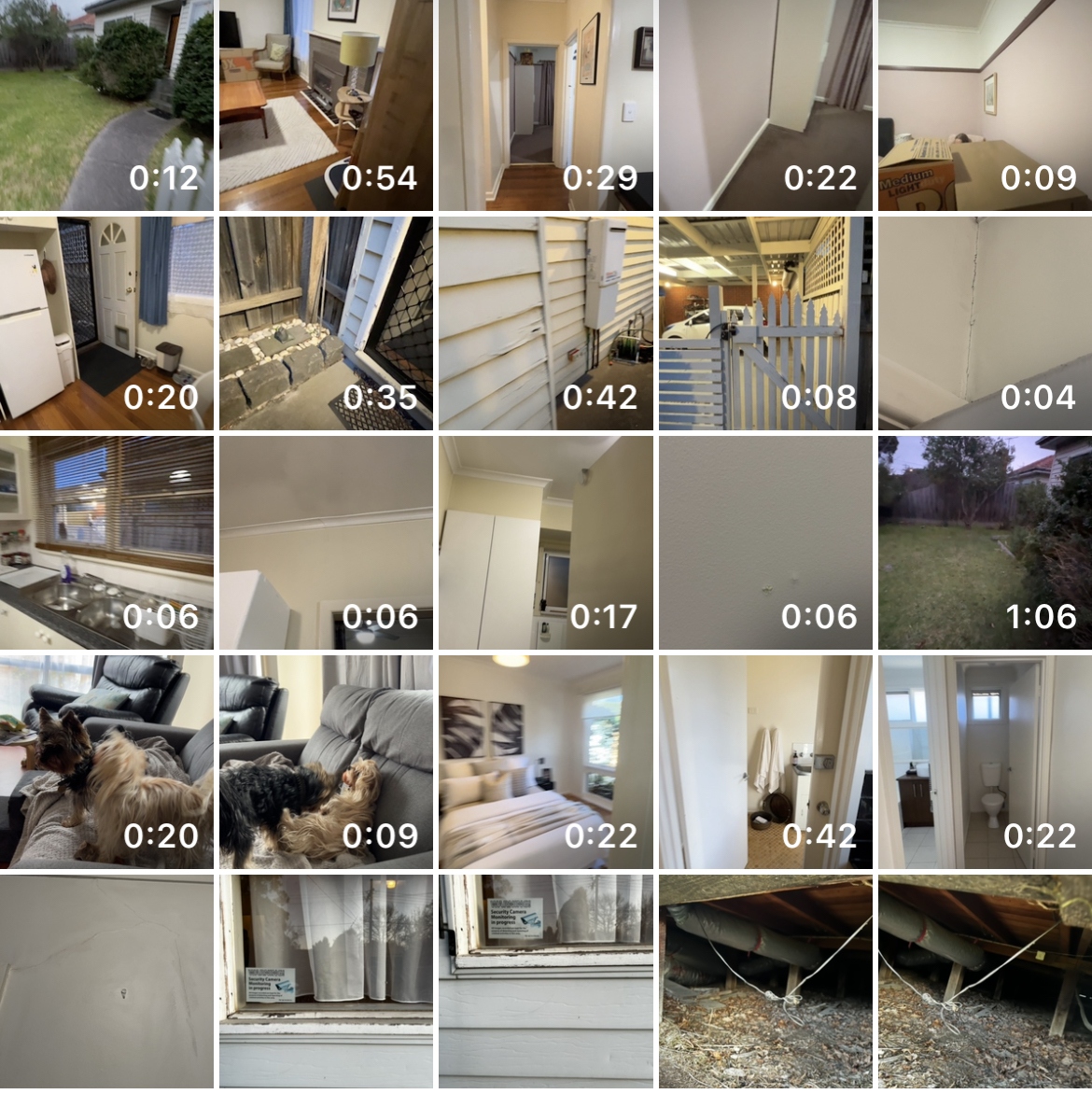

- Inspect a house house you like twice. On the first viewing, we usually can decide if the house is nice or not. But on the second viewing, we know if we would actually want to try to buy the house.

- Drive through the house/suburb in different times of the day. Once we found a house we liked enough to consider buying, seeing the area in different times of the day helped us assess the “safety” of the area. Inspections are usually in the morning/early arvo, with good sun. Seeing the area again at night after the initial “like” has passed helped me see the property in a more objective light. The house doesn’t look as “nice” or “charming” at night, and even worse when the streets are too dark (no street lights).

- Walk through the nearby streets, check out the public transport (if important to you), drive through nearby roads. Just get to know the hood around the house and imagine if you were already living there: do you like the surroundings?

- Look at different types of houses. We looked at units, townhomes, old houses, new houses. If we decided on one house, it is good to understand what we are saying “no” to. We can only buy one; we would like to avoid having buyer’s regret by seeing all the choices we can afford in an area before deciding on one house. Even looking at a house slightly above our budget is useful to confirm that we’re happy to stick to our budget instead of saving another year.

The confusion and isolation, uncertainty and worry were quickly swept away by this overwhelming support from our friends and I was filled with gratitude. We’ve got solid friends who didn’t mind driving with us to suburbs to see houses. Solid friends who encouraged us to participate in an auction even though the house was sure to sell more than our budget. Solid friends who didn’t mind going on WhatsApp calls to advise us on what to say to the agent as we negotiate. Every unexpected offer of help was accepted with gratitude that words can’t express.

Between Dylan and myself, I was the one obsessed with researching. We had to be able to decide on a value of a house by ourselves, which will set the amount we want to offer for it (or a max we would go in an auction or negotiation). In spite of the rising interest rates, some areas are still super hot for property and there are many groups with way more money than us willing to pay above the property’s value. Because the bank is only lending us the amount they estimate the property is worth, we really had to be careful and avoid overpaying.

- Auctions helped me understand the market rates; how much other people value the area and how far they’re willing to go to. I told Dylan there’s no point wasting our time bidding against people with more money than us. We will never win against a retiree’s deep coffers or mama and papa’s bank account.

- Corelogic reports gave an indicative estimate of how much a bank might value the property. I used this to gauge that we’re not paying above this — just to be safe.

- Recent sales and listed prices: gave an idea of what could be a going rate for the type of house we’re keen to buy (just comparing similar properties in the same or nearby areas). It’s difficult to trust the listed prices because agents could easily be under-quoting. Even for houses going on auction, we were getting calls from agents where the possible offers were going way, way above the listed price range. In some suburbs (usually the not-so-hot ones), the listed price is way above the objective value of the property. It didn’t take long for me to get used to this, although our friends are way better than estimating than me. I think I’m doing quite okay for a beginner.

- property.com.au – a free research tool I used to check info like flooding, bushfires, NBN, telco signals, selling history (how long has it been tenanted, how much did the current owner buy the property, have they tried and failed to sell before, etc.)

- Council websites are the place to go for development plans in the area, programs, etc. just to give an idea of what kind of council you might move into. Ideally it’s one that is going to develop the suburb into the vibe we would like to live in.

At first we looked at our “ideal suburbs”, particularly Bayside. Yes, so Dylan can very easily fish after work. Pretty quickly, we knew which suburbs we’re definitely priced out of. Some friends and I also managed to convince Dylan to consider suburbs he thought he didn’t like, primarily because we can get more out of our budget. There are areas that are definite “NO’s” because they felt too dodgy for our comfort. Every option had its pro’s and con’s, and we just had to rank what’s more important to us right now. What’s reasonable for a first house where hopefully we won’t mind living in for a couple of years.

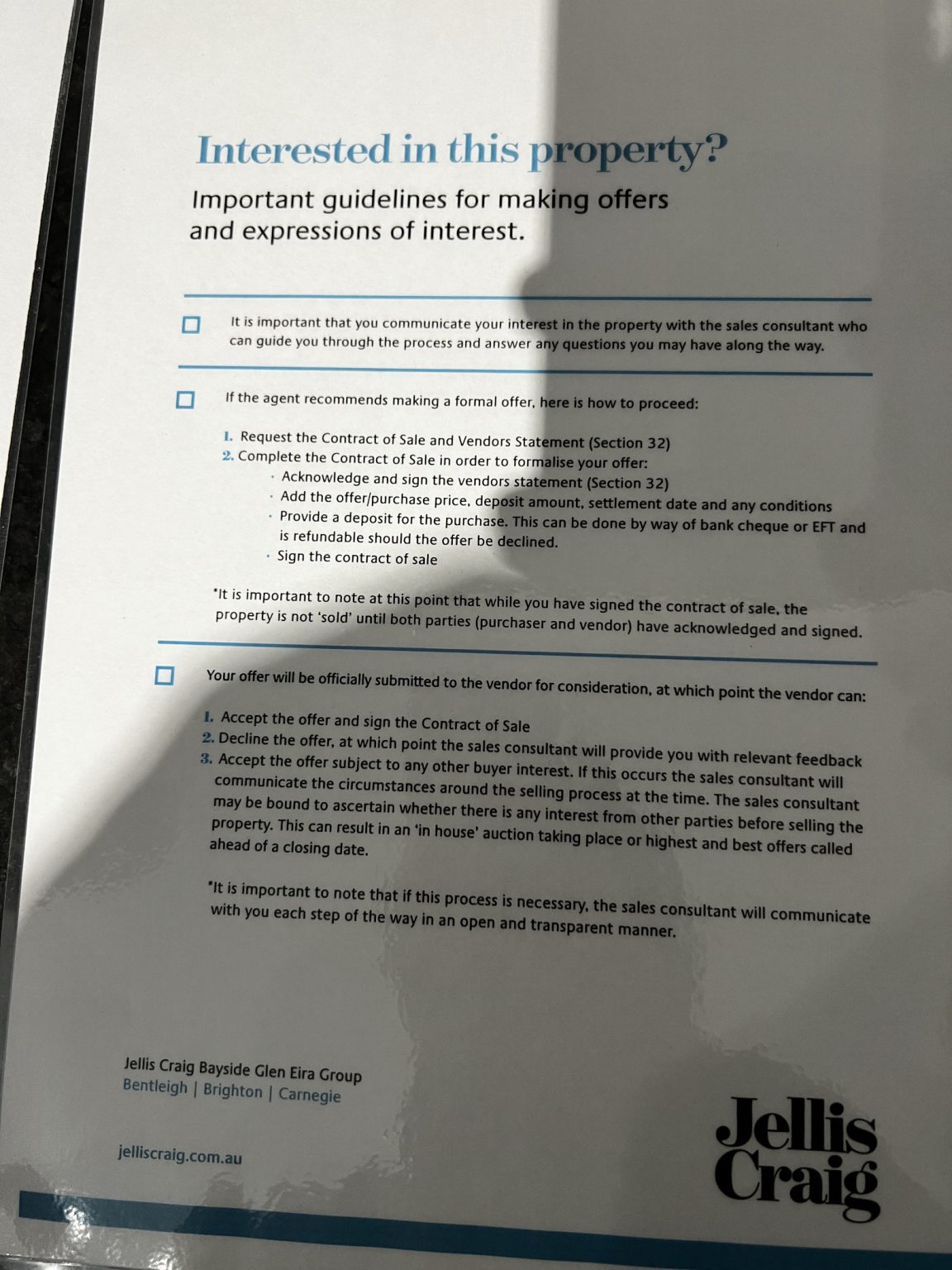

It’s only been a little over a month since we started driving around and attending inspections. We’ve experienced bidding for a property we couldn’t afford, missing out on a property that we liked and could afford, negotiating for a property that we didn’t initially like but eventually actually liked — and now we’re in the middle of trying to secure one. And if this falls through, that’s okay. We’re getting the hang of it. We’re more familiar with the different processes (auctions, private sales). We’ve got a good understanding of where we want to buy. We know what we want in our first house. We know what we like and don’t like. No matter what happens now, I’m sure we’ll be able to buy a house in the next couple of months.

And once that’s done, I can go back to wedding planning.

Leave a Reply