Tuesday was settlement day and I can now say that Dylan and I are officially homeowners! Woohoo! It probably felt so fast to our friends but the past two days were actually quite nerve-wrecking.

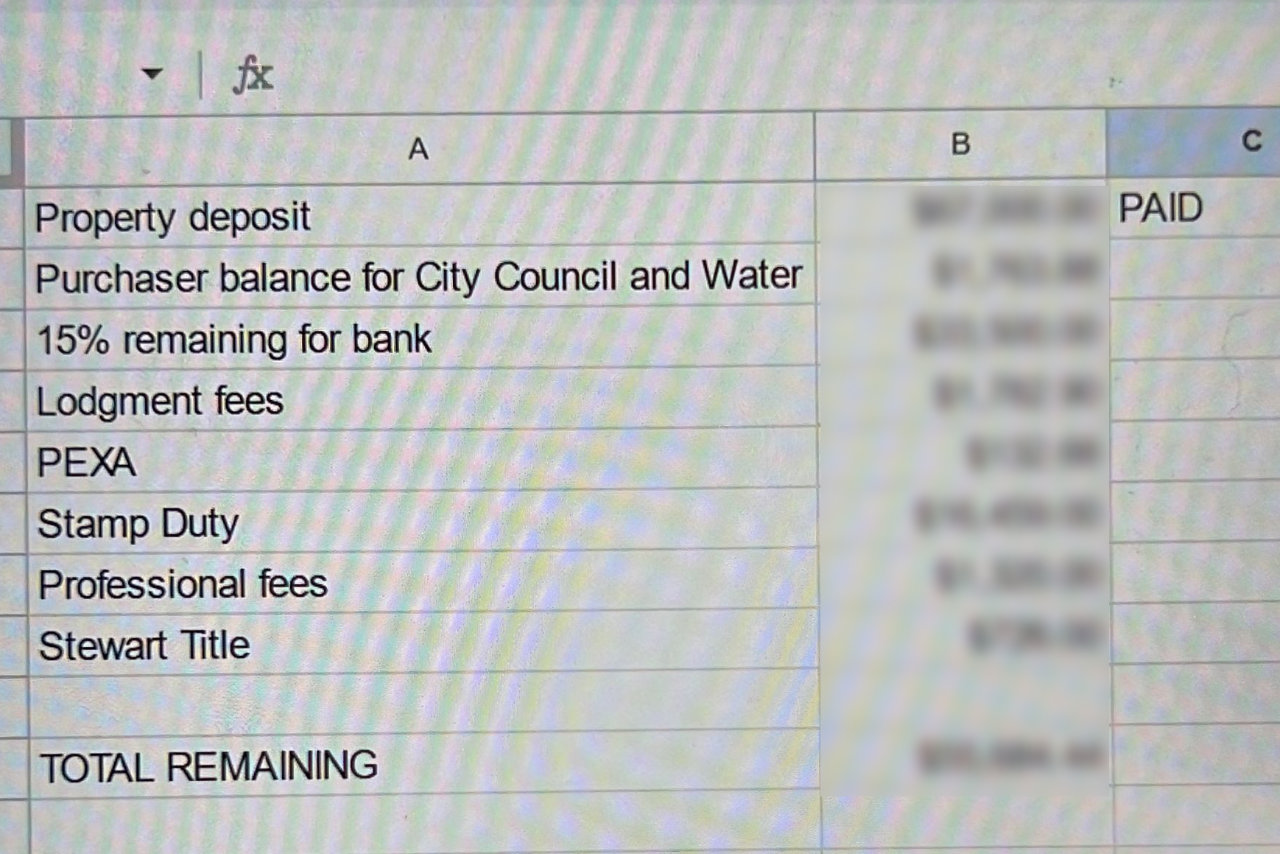

The day before settlement, we received the summary of expected fees from our conveyancer and the bank had told them this:

Currently the customer has insufficient funds in their nominated account to balance to your ‘total funds required’. Please liaise with the customer to ensure sufficient clear funds are held for settlement.

We had insufficient funds!?!?!?!?!?

That threw me off in the middle of work because wtf I will not be able to pull a couple of thousand bucks out of my arse in 24 hours! Was my maths REALLY this terrible!? At what point did I miscalculate??? Am I going to regret going for an earlier settlement!?

I redid the numbers in excel this time and the total checked out! I was so confused and lost and just so stumped at exactly how short were we??? 🤯 It didn’t help that this was happening at about 2pm, which wasn’t enough time for us to get anything clarified before 5pm or end of business hours. In the middle of all this confusion our conveyancer finally responded saying it could be because the bank calculated our stamp duty wrongly and didn’t apply the first home buyer concession to their totals. COULD BE??? Can we please be more certain about that!?

Our conveyancer said they will ask the bank and so we had to leave it up to them to sort it out. I mean, of course they’re not sweating their pants because they don’t know we don’t have an extra $15k lying around to transfer willy-nilly. Dylan had to reassure me that it’s probably okay, and so I forced myself to forget about it and try to get a good night’s sleep.

I tried.

Also tried not to think too much about it the next day, which was SETTLEMENT DAY. It was a Tuesday, which meant I had a full day of meetings and social interaction at the office. It was a healthy amount of distraction because it wasn’t until close to 1pm when our conveyancer emailed us to confirm we were not insufficient after all:

We have followed up with <bank> and we are OK for the settlement.

The funds are sufficient and we are waiting for the settlement to commence at 2pm.

Thank you.

Yassss, we have ken-ough! You’d think all would be good. Phew, right! Everything confirmed to be in order just an hour about the settlement time!

The next hour rolls by and at 2:18pm we get another update from our conveyancer:

So far we are waiting for the vendor’s bank to complete the document so that the workspace can progress.

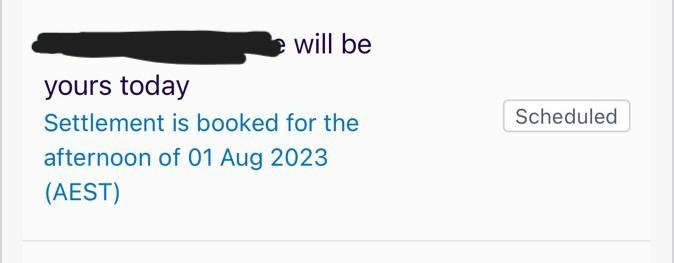

Oh okay, it’s not yet even half past two. Sure, we can wait for the vendor’s bank. And the day goes on, I hop onto another meeting, and still no news that settlement is in progress. Dylan and I were just giving pep talks to ourselves so I sent him this screenshot from our bank’s app:

Me: App said TODAYYYYY

Dylan: i just need keyzszzszszszzzzz

And about 4:05pm, our conveyancer said we are now just waiting on our bank to sign off. She said they will sign off before 5pm. Given we’ve been on edge the whole afternoon, Dylan gives our broker a call anyway, which was such a good idea as he said he will look into it. (Thank you, Andy!!)

So all this while, I assumed all teams are clocking off at 5pm. That’s the typical Aussie working hours. The vendor’s agent had checked in with us if everything’s been completed because we’ve yet to arrange getting the keys from her. So here I am, keeping her posted so we can still get the keys on the same day. I wasn’t sure if all the relevant people will still be around to complete the settlement as I have no idea how it all works in the background. I was just keeping my trust in the bank app: it said the house will be ours TODAY.

Dylan in the meantime has been undecided if we should reschedule our pest inspection. We booked one at 8am the next day to get a quote for termite protection before we moved in. In hindsight we probably should’ve booked it a day or so after so we weren’t cutting things too close but what’s done was done. We were committed to waiting it out until the very end of the day.

And as it was, so was the bank.

At 4:08pm, Dylan messaged me:

jackie just replied saying the settlement ready and will start at 5pm. jackie will let me know once complete. should take about half an hour

So we went from 2pm to 5pm. Is that normal? I don’t know. We’ve only ever done one settlement, and it feels like we were lucky it all went through by the end of the day, which meant WE GOT OUR KEYS!

Beginning of an odyssey

I can now celebrate going back to having no money by writing this snapshot of what it’s like to buy a house in Melbourne in mid-2023. I’d like to look back at this post in the future and say, “houses used to cost only thaaaat much?!” and subsequently worry about how would kids these days afford them!? I’m neither financially savvy nor a property investor. I just wanted a home to live in, and here was what I went through to accomplish exactly that:

Saving

The biggest barrier to purchasing a house (to me, at least) was the cold, hard cash you’d have to fork out for the deposit and fees. Dylan and I are both on good salaries so servicing a loan is easy, but having all the cash for settlement is hard. It takes time to have a big chunk of it ready to spend when you’re coming up with the funds by yourself.

I don’t think you’d be able to buy a house in Victoria without at least $100k in cash unless you had guarantors and other grants. And that’s for an outer suburb, or smaller townhouses within a 30km radius from the city. Can you buy with less than that? Yes, but you’d have to be realistic about what you can buy.

Goals are achievable when there’s a finish line to cross, so just setting an achievable amount to have within a specific time frame is an effective way to kick things off. At work they call it “SMART” goals: Specific, Measurable, Achievable, Relevant, and Time-Bound. I just have to apply the same concept to my personal life. Save <X> amount by <Y> date.

It doesn’t matter how early you start planning the financial side of things. The earlier the better. I was always conscious about how much I spend towards my lifestyle, travel, and hobbies. Although I now spend more since having Dylan and two dogs in my life, my personal spending habits hasn’t been that much different from when I was in my early 20’s. Sure, I am not as frugal anymore that I’d book dodgy hostels when I travel, but I also still don’t own any luxury bags (some days I think, maybe I would like a LV or Chanel, but there always were other things more important to me). To save, Dylan and I have always kept on the cheaper side of renting, whether its going for an older apartment or getting “mate’s rates” from friends. We go on out of town trips, play video games, and keep a few subscriptions but we’re still very decisive on what we allow ourselves to spend on. Small sacrifices for bigger things.

My house-buying time frame also influenced my investments and risk appetite. Decisions I made would be different if I were planning to buy a house in 5 years (room for risk) versus buying in the next 12 months (playing it safe, so I could just top up my Super contributions). Five years ago, having freshly moved to Australia, I wasn’t fussed about my salary because the work visa was more important to me. But at one point, earning more or being on market rate became more important because I needed to maximise my income to improve my borrowing capacity. So I had to shift my focus and made sure I achieved that. Dylan had his own ways of growing money, and we just pulled our funds together so we can buy a house sooner than later.

Saving for the deposit was just the first step for me and once I’ve reached that goal, it’s time to think more seriously about what exactly was needed to buy a house.

Preparing

So, I’ve got a good headway into my savings. What’s next?

The time waiting for our Permanent Residency was spent on educating myself: on houses, property-related concepts, interest rate news, and varied opinions on the housing industry in Australia.

Since last year, I’d occasionally look at properties for sale on Domain’s app. I preferred it over REA because it showed me price changes of properties I bookmarked. By doing this, I could see how the market was doing: are house prices were going up or down? Are certain suburbs still affordable or still out of reach?

Seeing houses I liked get sold for an amount I assumed I could afford was an amazing motivator. On another hand, seeing myself priced out of certain suburbs can also be considered a motivator…to either earn more or buy sooner before prices go out of hand.

Of course there is the remote possibility that prices will come down, but just the fact that demand for housing is high in Australia, I can’t imagine price ever going down much in the near future. Just on this point, our friend who bought a 3-beds/1-bath/2-cars house further East for $650k already saw his house value go up as properties are now selling for more than that — months after he bought. A townhouse is now at that price range in the area. So just keep yourself posted of how things are going in property-land by reading or occasionally checking out property prices.

/r/AusFinance was a subreddit that I browsed regularly, with the added benefit of reading through people’s opinions in property discussions. This was where I first tried to grasp the difference between Offset Accounts and Redraw Accounts. There are also healthy discussions on debunking assumptions about apartments as bad investments. There were occasional posts about the First Home Super Saver Scheme and other first-home buyer questions that I always found useful, including the importance of building and pest reports prior to buying both old and new dwellings.

I also took advantage of some tools or apps that helped me deal with the house-buying process:

- MyFutureHome.com.au was an online calculator I kept going back to. It gave me a rough idea of my maximum borrowing power so I could plan around a more reasonable budget that won’t push our repayments to the limit. I wanted to track exactly how much the maximum property price should be so we can still afford the stamp duty and other fees. (It was also unexpectedly more humbling later down the road because Dylan and I ended up setting our budget just above half of our max borrowing capacity.)

- My transaction account with Dylan is on Up Bank, which made tracking the categories of our expenses super easy. Apart from making budgeting so convenient, it ended up being very handy when filling out any other online forms for loans or other assessments where they would ask us to break down our expenses categorically. Anything that made applications easier down the road was a welcome convenience.

Another item on the preparation list that we didn’t have to do anything for was…credit cards. In Australia, the concept of “credit” is different from the USA. You don’t need to “build” credit via having a credit card. It’s more favourable for loan applications if you are debt-free, which Dylan and I were before we applied for a loan. We couldn’t successfully get a credit card a year ago because we were on our bridging visa and by the time we got our Permanent Residency, we were already ready to buy a house so there was no time to open and close cards.

Loan applications will include credit card purchasing limits, which could lower our borrowing capacity. It was probably not an issue since we ended up borrowing far below our maximum but I had this unfounded belief that the simpler our loan application is, the fewer our chances for unexpected hurdles.

Buying

We’ve got our savings and a little idea of what’s needed to buy a house. What’s next?

Some people say talk to a broker to work out how much you need or what you can afford, but honestly, online calculators like MyFutureHome.com.au are accurate enough that I would recommend using that first and then only going to a broker once funds for the deposit and other purchasing fees are ready.

There’s also the choice of not going through a broker at all. I’ve known some friends who opted to go through the loan application themselves, and they had purchased a house without issues.

Broker or no broker, one thing I would’ve done more urgently was to get a loan pre-approval from the bank. Dylan and I started going to house inspections before we got our pre-approval. It meant that if we found a house that we really liked, we couldn’t confidently make offers in a range that we’d be reassured the bank was highly likely to lend. When we made our offer, we were still waiting for our pre-approval. 🥹 A little risky but we had “subject to finance” in the contract so there was some wiggle room in case things went south.

We decided to go with a broker because:

- He was recommended by a very good friend, which is always a plus.

- It was our first time buying a house in Melbourne, and the extra guidance from someone experienced was invaluable. We received a lot of help from friends who eased us into the details of buying a house and even accommodated all our stupid questions, but there were moments in the process where we had relied on our broker to fill in our knowledge gaps.

- He shared core logic reports for properties we were interested in, which made our personal valuations of properties easier. Dylan and I could easily agree on a price range that we would be willing to pay for a property. The reports also made it easier for us to set a max limit on how much we would pay for a certain house, as we made sure we’re not going above expected bank valuations.

- He helped set expectations on how long certain parts of the buying process would take. Again, having never done this before, this information helped me visualise what a purchasing timeline would look like.

Going back to our settlement day experience where our broker was there to reassure us things are okay, and was there to follow up on the delays — I now say I am so glad that we went with a broker. (Let us know if you’re looking for one, always happy to recommend, and he has clients in all states of Australia.)

The first thing he told us to do was: work out our budget and get back to him with the total cash we have. Dylan and I locked in an amount we were willing to cash out, and then from there worked out our maximum property price.

I used the FHSS Scheme and if you will be doing the same, this is the moment where I will recommend logging onto ATO and submitting the form for a determination. It’ll tell you how much you can withdraw, including any earnings and the tax that will be deducted. A determination does not mean they will release that fund into your bank account; you can submit the form as many times as you need especially if you’ve been topping up your Super contributions. It’s just important to note that the latest determination will be the max amount you can withdraw.

I also recommend doing the release of funds early on (once you’ve decided you’re ready to look for a house, and even before you’ve found a house you’d like to buy), especially if you plan to use some of that cash for the 10% deposit payment to the vendor. Although deadlines will vary a bit, the 10% of the property price is a required payment once a vendor accepts your offer or once you win an auction. Funds from FHSS will take about 14-25 business days to be released as per the government website, and although it took about 11 days for mine to be transferred into my bank account, it’s never going to be fast enough if you’re planning to use some of that cash for the 10% deposit.

A conveyancer or lawyer is another person whose service we had to engage, and was also recommended by a friend. For every property we wanted to make a serious offer to or auction we wanted to participate in, we send the contract (or Section 32) to the conveyancer first. They go through the contracts and flag anything that’s missing or items to look out for. Cost was around $1-1.5k from start to finish (which is until settlement). There were things we didn’t realise we should be asking about until our conveyancer pointed them out, like has the property been a meth lab before? To which one of the property agents said it gave them a chuckle because they imagined grandma making meth hahahaha.

The actual buying process is just a cycle of house inspections, building reports, auctions and private offers. Rinse-and-repeat. You’ll see how it can get costly if auctions and offers fall through. I’ve already written about the nitty-gritty of the buying process so I’ll leave the details there.

Golden nuggets I’ve picked up a from other people:

- The best time to buy a house in Australia was 20 years ago.

- The best time to buy a house is when you’re ready to buy a house (i.e. you have the funds). Don’t try to time it if you are buying a home (vs. for investment).

- Winter is a slow season for properties for sale. This year it was a little worse because the interest rates have been going up throughout the season.

- Spring is typically where things pick up again, and where buyers expect more houses to be on the market.

- Keep going to auctions and you’ll be able to value a house easily yourself in no time.

- Always get a building inspection done, even if the property is new.

- Keep a 10% buffer as a bargaining threshold when making an offer.

- But also know your hard, hard limit when it comes to price and stick to it.

Deciding what to buy and where can be hard if you’re indecisive, or easy when you have a limited budget. Type of dwelling (house, apartment) and location is very personal. At the same time, price was the biggest influence on the suburbs we could buy into. We had a mental list of must-haves, and I think we were quite flexible throughout.

- Apartments are too small; we enjoy outdoor hobbies and need all that space to store bikes, camping and fishing gear, maybe a kayak among other things.

- Townhouses are okay, but detached walls would be our preference.

- Free-standing units are fine too, as long as strata was reasonable and space still mildly generous.

- We’re not looking for big land with grass and gardens to maintain, even though it’s land value that appreciates the most.

- No carport is a BIG no-go for us.

- Walking distance from a train station or bus stop is a must-have.

A lot of people often say, property is about location, location, location. It’s true, but location is also very personal: it could be near work or near family, or a school catchment you’re dying to enrol your future kids in, or a busy town with all the shops in walking distance, or near the sea for fishing and swimming. There’s vibe, space, public transport — things important to our lifestyle. I don’t think there’s a right or wrong in terms of location. Ultimately we have to choose what will make us happy.

At the start of our house hunting odyssey, we very quickly realised we’re priced out of some suburbs we liked (unless we pushed for a bigger mortgage. But! We were sticking to our set budget). We could keep looking at “inner” suburbs and our selection would be limited to: units, old houses that will need renovation, or apartments and smaller townhouses. We prefer South/South-east suburbs, but considered East for affordability (which was slowly going up, too).

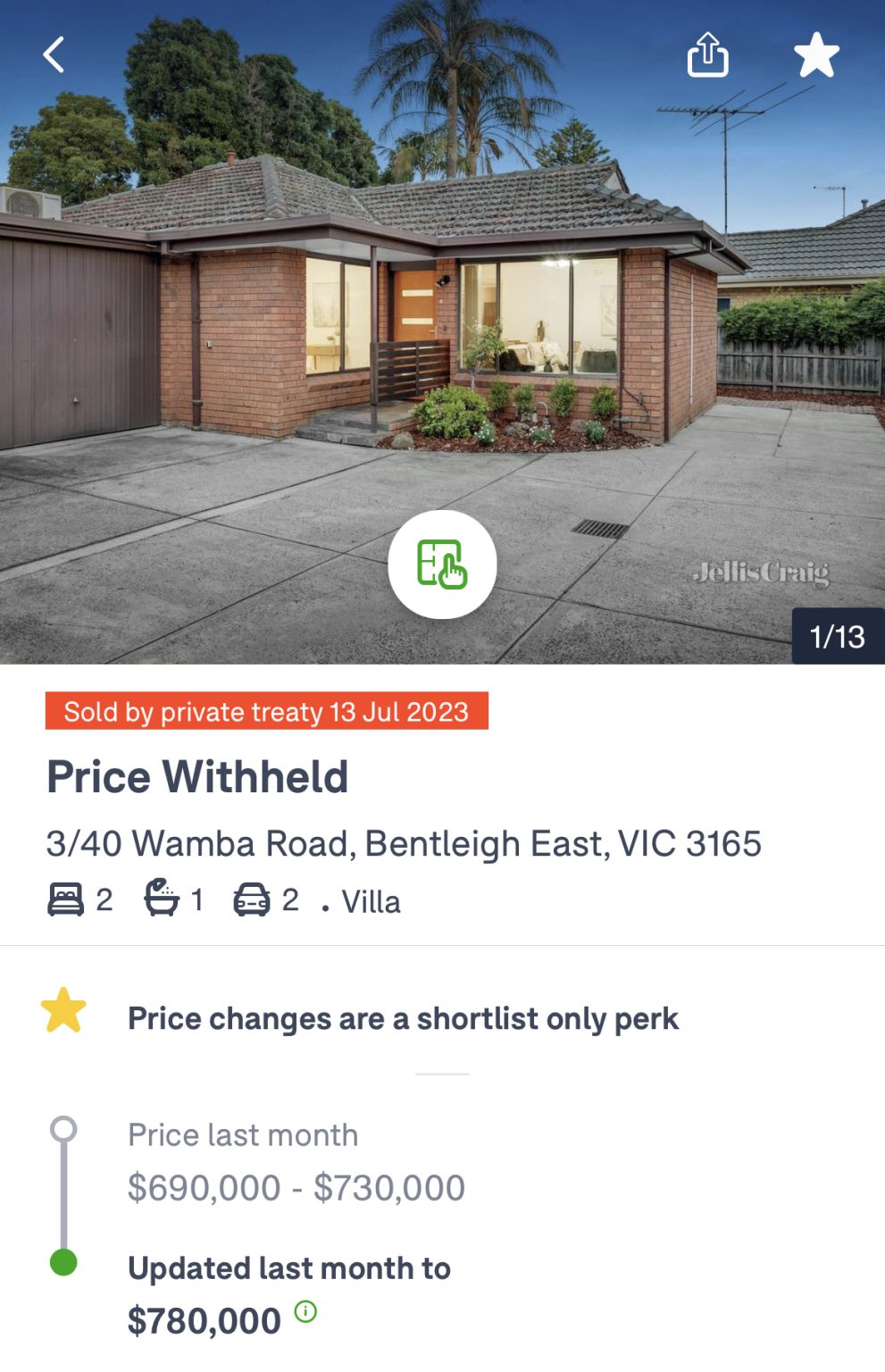

- Bentliegh East would’ve been really nice, but by the time we were looking at the market, units were selling for upper $700’s to $800k+

- Clayton, which we like because of all the Asian shops, have units and townhouses selling for $800k-$900k.

- Moridalloc, Mentone, Moorabin, or alongside that area had some 2-bedroom units in our budget up until March this year. Unfortunately, we got our PR in May so only started looking in June and things had gone up a bit by then. The nicer units were at the upper end of $700k. Cheltenham was even worse, with people buying 2-beds/1-bath/1-car units for $800-900k.

- Okleigh, Mulgrave, Ormond are all at the $800k+ range.

- Ringwood and surrounding suburbs were at upper $750k-$800k+ for two to three-bedroom townhouses or units. And Dylan doesn’t like the roads here so I quickly crossed it off our list.

- Ferntree Gully, Bayswater, and further east where we are renting is still within the upper $650k-$750k range. I heard that many Hongkees are moving into these suburbs that even the 2-beds/1-bath/1-car if near the station are falling within the $700k range. Further east is near the mountains and every morning this winter, I would wake up to a damp room and a very cold old house. It just gets colder in winter than what I’m used to, so I am not keen to keep living so close to the 1000 Steps. Only a well-insulated house will convince me to keep living here, and each time we drive back south or west, I can feel the clouds open up and see the sun waving. I miss that. I want more sun, and here near the mountains doesn’t feel sunny or warm enough.

- Vermont and Forest Hill gave us an “older families” or “car-only” vibes (there’s no train lines and bus stops weren’t plentiful or at convenient spots), so they were a no-go.

- Ashwood was quite nice, even if there wasn’t a train station in the area, but being close to Chadstone, there were a lot of Asians with more purchasing power than us who are driving up the price of townhomes.

- Burwood East was quite nice but you’d have to drive around to get to shops and other areas. It’s also expensive.

- Rowville was okay, very suburb-y but very “car-only”. Every time we drive by Rowville from Ferntree, it’s mostly just residential housing with not a lot of shops (from the roads I see). So we weren’t a huge fan.

- Wantirna, Scoresby, and Knoxfield I quite liked, but there are no trains.

- Dylan had veto-ed and said no to: Noble Park, Springvale, Dandenong.

We were ready to keep looking at small 2-bedroom, 1-bathroom, 1-car units we can afford. We were ready to brave through auctions in hot suburbs where people were bidding $100k above the listed price range until we got lucky. It was winter still, so few houses were on the market, and everyone said there will be more options in spring. This is why people take twelve months and more to find a house.

But the moment our friends convinced us to look further out and we started inspecting bigger houses, a wave of nostalgia hit me. It reminded me of my parents’ home back in the Philippines and I thought about how nice it would be if our future kid could grow up in a bigger house, too. The moment we entered a house with tiled flooring, I knew Dylan already loved it — precisely because that’s the kind of home he grew up in (it wasn’t the one we ended up getting).

Looking outwards and further out from the city sparked a desire for space that I didn’t initially think mattered to me. It just felt nice, and imagining having one of our mums visiting and staying over to help with a future baby suddenly seemed easier, too. Maybe I didn’t want a much smaller two-bedroom, single-bathroom after all.

Dylan and I realised that, huh, we seem to prefer a little bigger space. Not too big that we need an 800-sqm land, but a happy medium that had at least 3 bedrooms and 2 bathrooms. We liked areas where roads were wider and cars weren’t all parked on the street. Dylan preferred highways while I wanted a train to bring me around if possible. We didn’t care about being close to the city; we wanted to be closer to the south where in warmer seasons we would drive to the sea for fishing or weekend day trips.

We wanted a little convenience: nearby shops and walking distance to the train. We didn’t want a huge backyard or garden that will need mowing and maintenance, but we wanted some patch of grass for our small yorkies to roll around on. We didn’t need a perfect house but we also didn’t have the skills and extra cash to do major renovations either. For a first home, we decided we wanted something that’s ready for moving in with just a few areas we can improve on over time (solar and better heating/cooling for maximum comfort being on top of the list).

And so with all that consideration, we eventually found a house we wanted to make our home.

Moving

We’re moving in as fast as we’ve settled. In just a little over a week, we’ll be moving house again (we just moved last May). I haven’t even unpacked all the boxes we had since we last moved three months ago! There are a couple of things that had to be set prior to settlement date, which means that at this point we can pretty much start living at our old-but-new house:

- Home and contents insurance, all booked prior to settlement (also required by the bank).

- Electricity and gas signed up before final inspection.

- Broadband connection scheduled to be connected today, ready for when we plan to install the security cameras this weekend.

Our friend has advised us to take more time before moving, so we can look at the house after settlement and have time to make changes or fix things before we filled the house up with furniture. Dylan and I went through our list and decided that most of it we will do after we’ve started living in the house. The only things we wanted to set up prior to moving was the security cameras and a termite protection plan.

I already started buying a few things, like a more comfortable king-sized bed that had springs (I’ve wanted a spring bed ever since my body started to feel that the Koala foam bed I was duped into buying wasn’t comfortable after all). July was the month for end-of-financial year sales, winter promotions, and stock clearances. I couldn’t take missing out on some good deals so I ended up buying a few items that are now going to be delivered to our new address.

Timing the deliveries while we still lived in our rental is a future-me problem.

Deciding on the furniture to buy sounded fun until I’ve got 2 hours left before the sales end. There were some pieces from Castlery that I really, really desperately wanted but I had to find some alternatives because I really, really need to control my spending. Cash is limited after settlement :P and we need a few months worth of salary to start buffing up our savings. There are things that we absolutely need (like the fridge and a mattress), and a few that I just really wanted to get on a bargain: dining table and chairs, and a bigger couch. I can finally splurge a little on something better-looking than IKEA.

Dylan and I walked through some furniture shops last weekend and none of the display dining sets and bed frames were going to be a steal in style or price compared to my online options. The online brands had more affordable, better-looking styles and the only thing I needed to do was shop around virtually and compare prices.

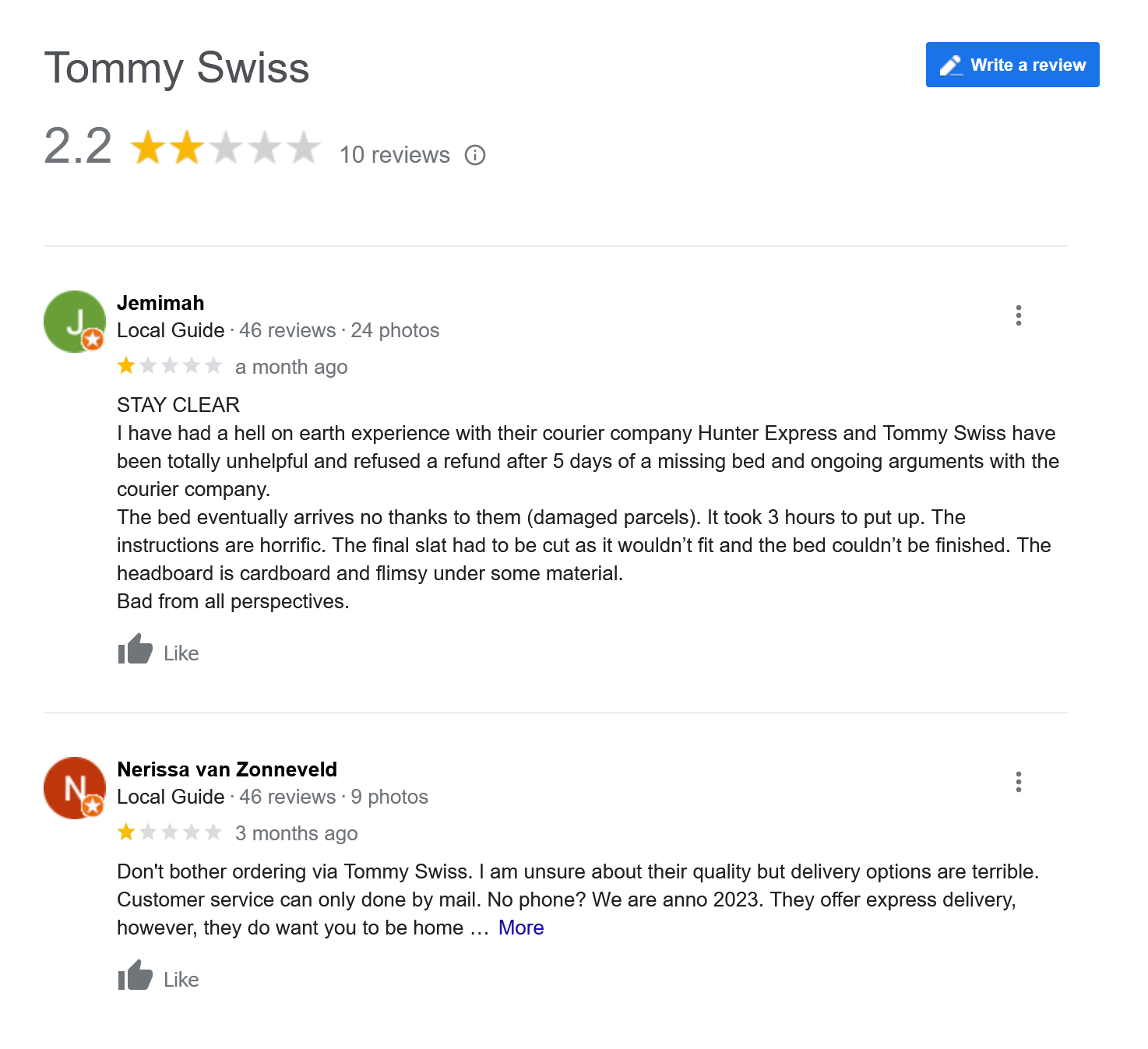

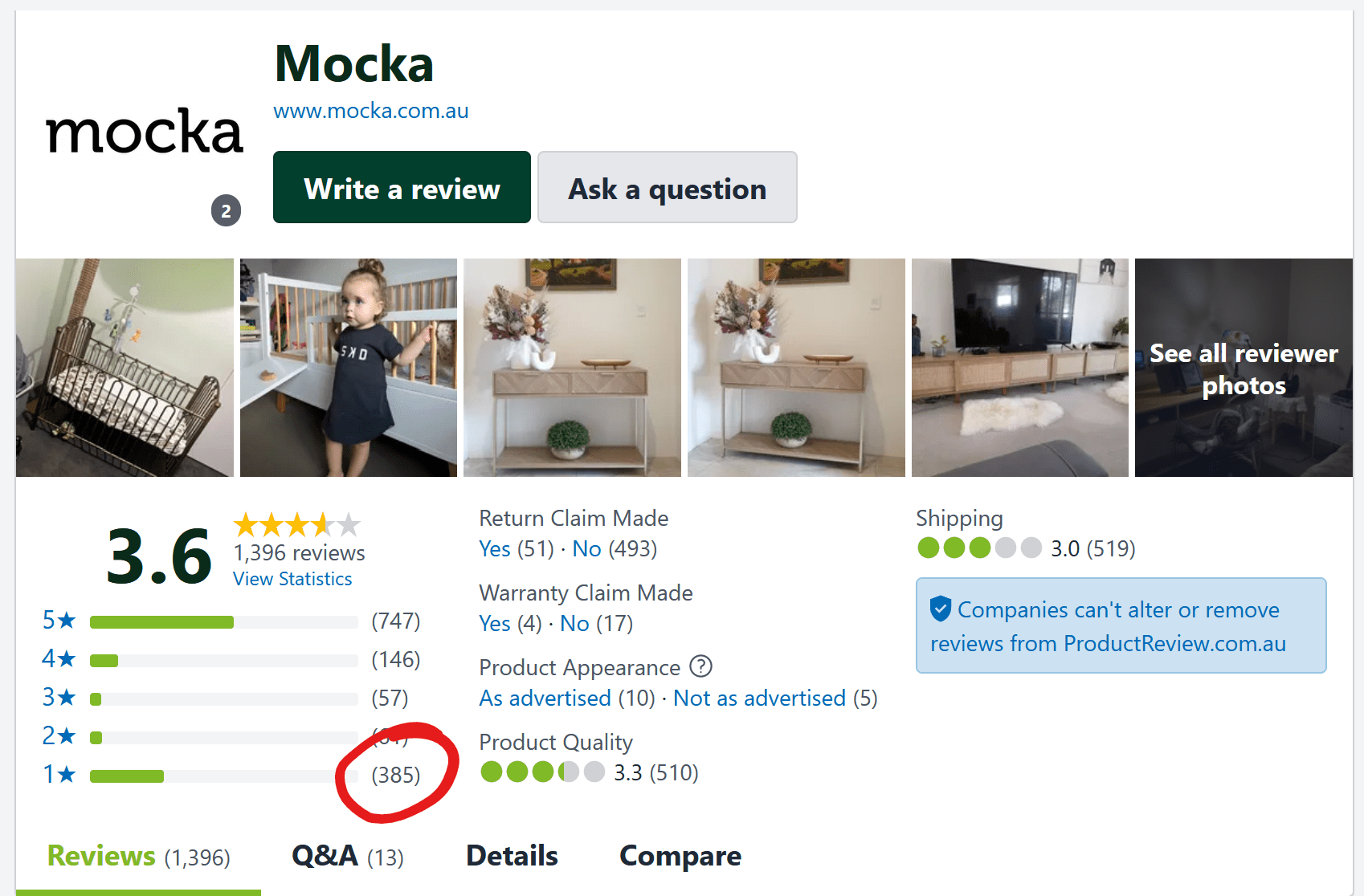

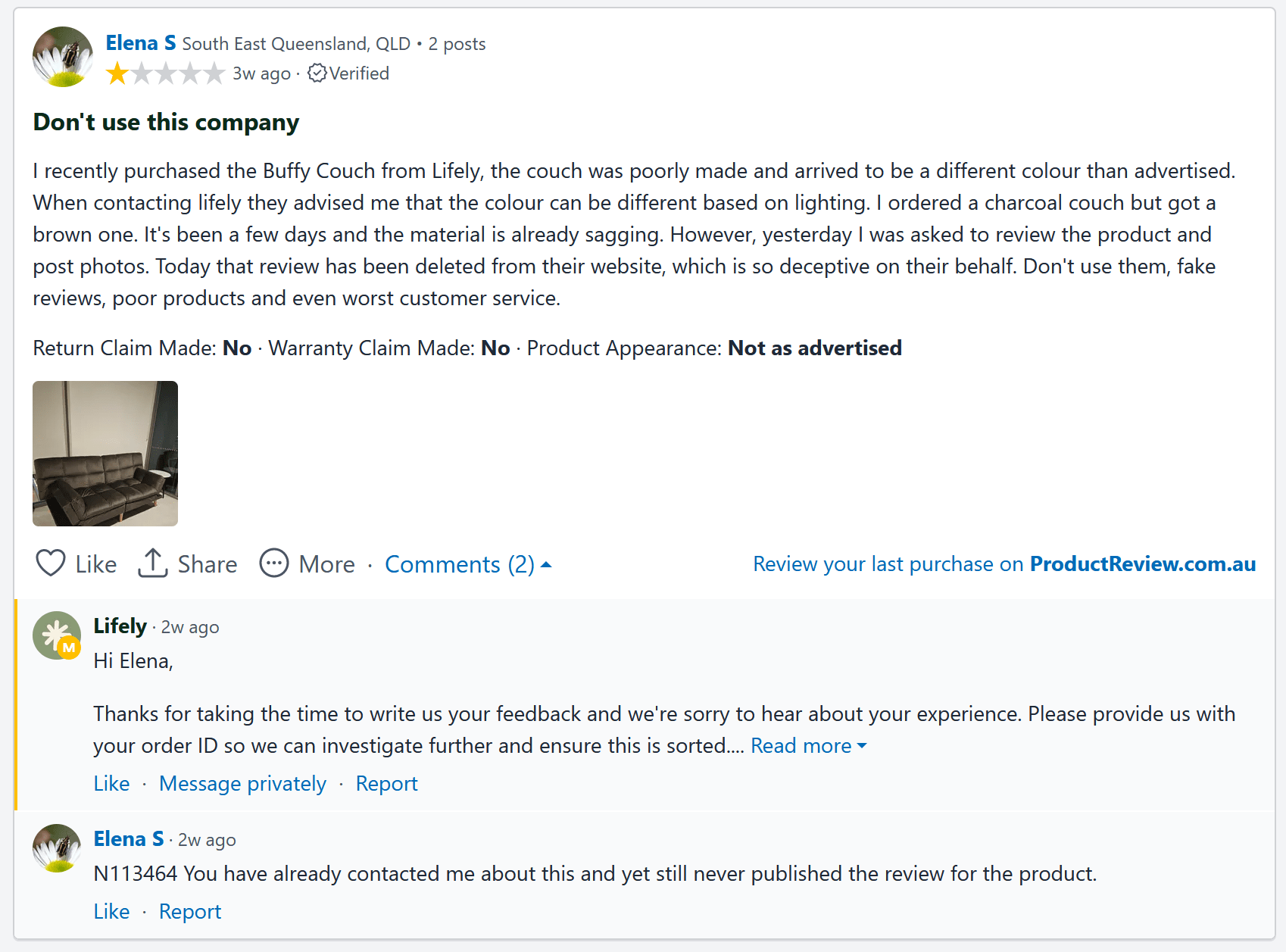

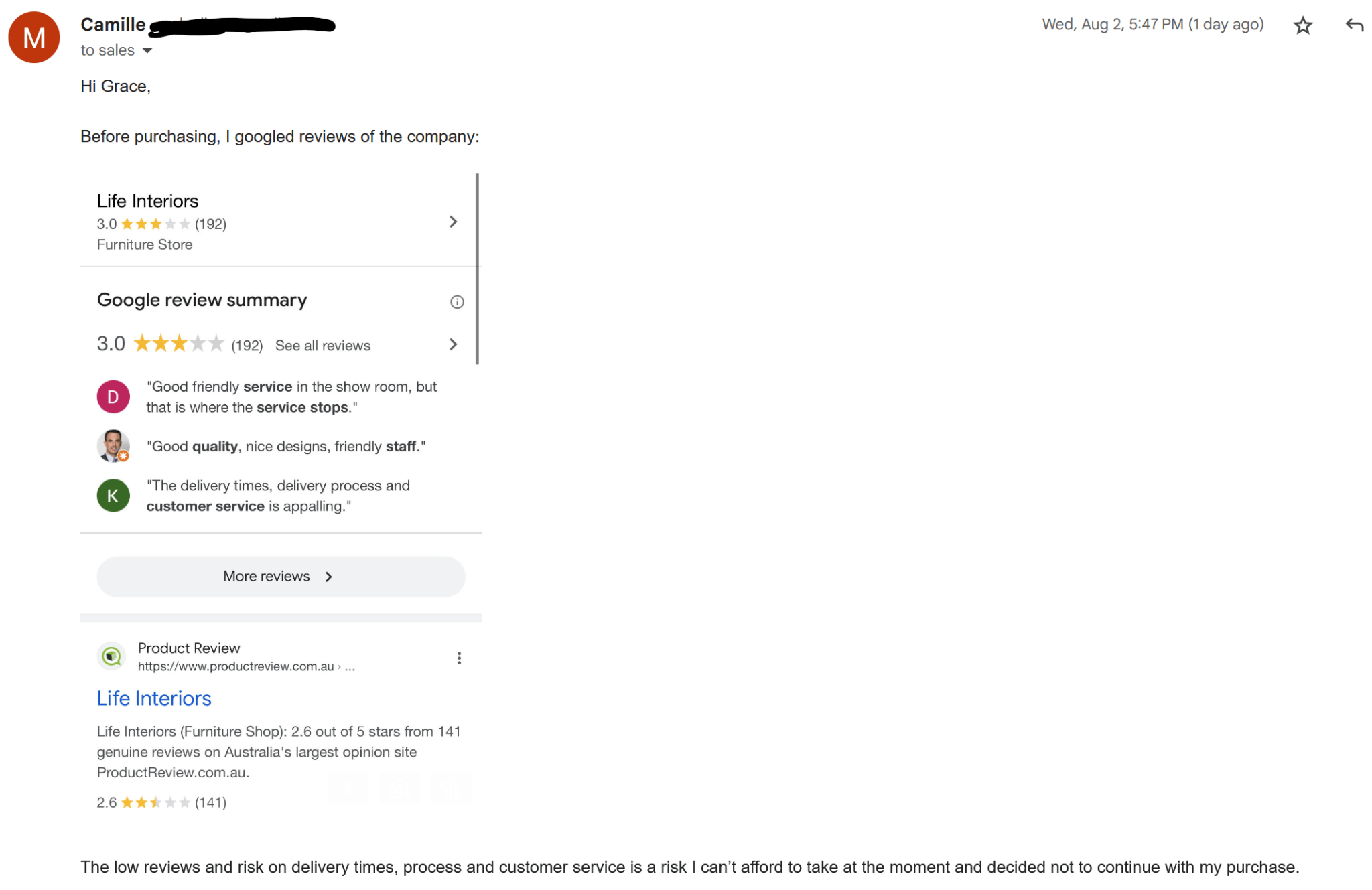

One thing I realised very quickly was that the trendy, cheaper online furniture shops usually less-than-stellar reviews and customer experience. It gets really tempting when you see the price of new furniture they sell can be cheaper than some premium second-hand items on Facebook Marketplace. Just look at Mocka, Lifely, Tommy Swiss, and those photos look so good and trendy! But I start looking up reviews of the brands themselves and suddenly I’m not too sure I want to click on that checkout button:

It is tough deciding, I tell you! Finding that sweet spot between good quality and visually aesthetic, trendy furniture with good customer service and delivery experience seems to come at a slightly more expensive cost.

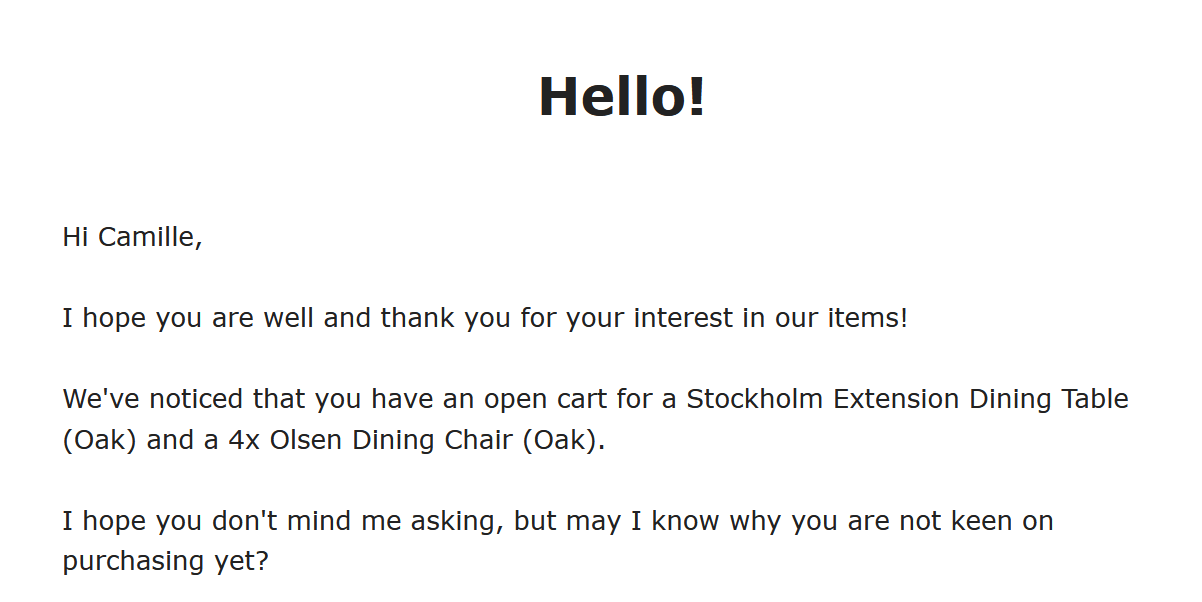

I received one of those automated emails sent to customers who left an item in their cart, and one of the furniture companies phrased it in such a way that they asked me Why? instead of just reminding me to complete my purchase:

5 Stars!!! They must have a good customer-oriented person who wrote this template. I loved this, and given my User Experience background, I put on my customer hat and replied:

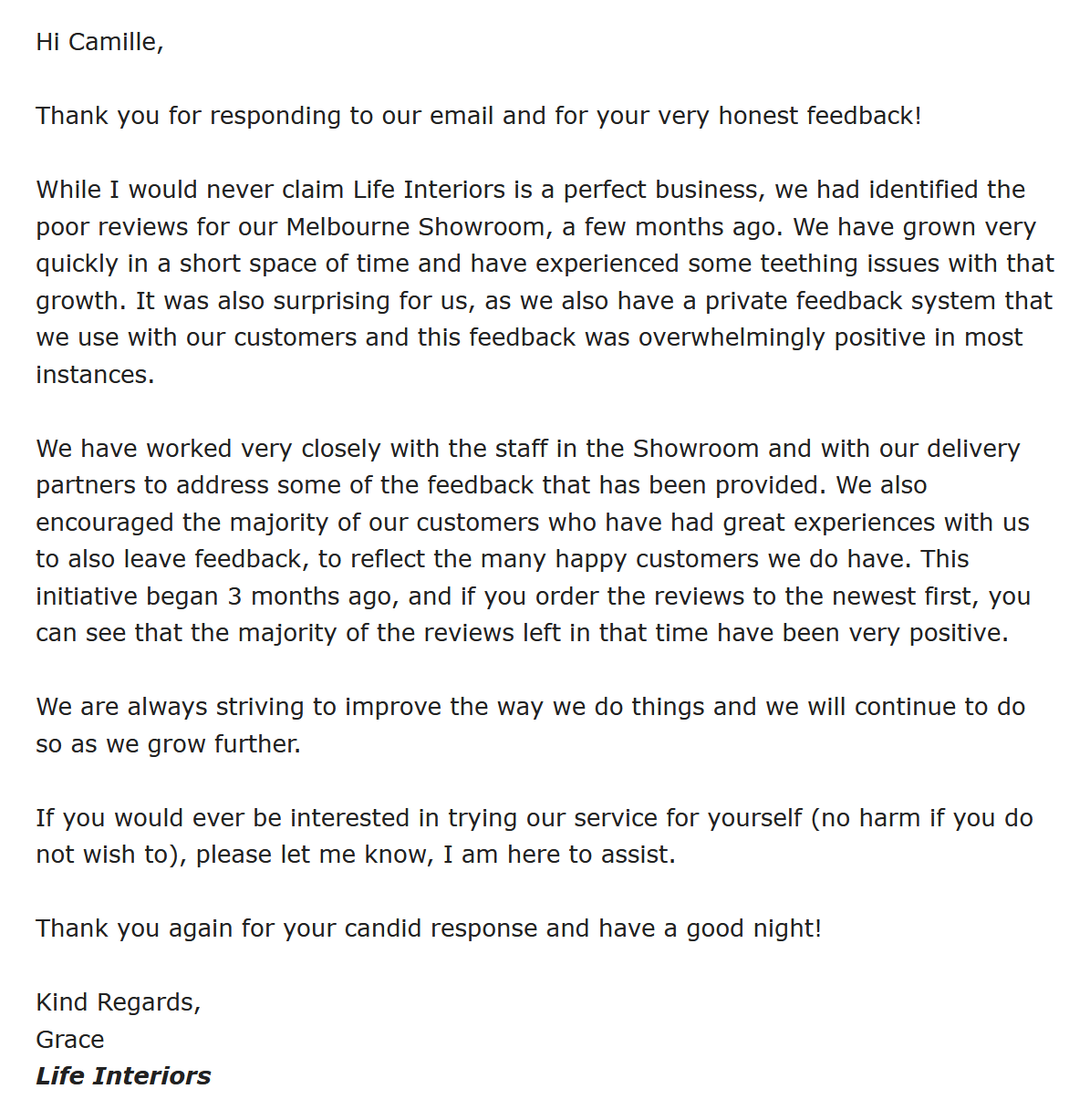

This was their response:

And with that interaction, their brand is back on my radar and I’ll be likely to consider them again in the future. Unfortunately, I’ve already bought a dining set from another shop whose customer support has aaaaaamazed me: Glicks. Good price and good reviews. But what surprised me was that a few minutes after I checked out, I received a call from their staff confirming the delivery schedule for this coming Saturday. Their driver will also call on the day to give a time-frame of expected delivery. I was really so impressed getting that real-time call, and one-hundred-percent I will have them on top of my list if I were looking to buy more furniture!

Things are arriving this Saturday; the bed base arrived today. We’ve got power at the house so technically we can already sleep here overnight! It’s so tempting, and overall just exciting. Only after settlement day did it really hit us that we have our own house now!!!!!! It feels so, so good.

I can’t wait until next pay day where I get to top-up my spending fund so I can buy more new things for the house and decorate all the rooms and start making it feel like our home. I’ll be sure to write again about some of my shopping adventures but our house-buying story now ends here, where our House-Owning chapter of our life together has now started.

(Trying not to forget wedding planning as we’ve still got that date set for next year, hah!)

Leave a Reply